Compensation Challenges in Publishing Subscription Models

Subscription plans have made their way into virtually every product and service line imaginable, to the extent that the Federal Trade Commission has proposed regulating them. Just as Software as a Service has all but replaced purchased software, subscriptions have infiltrated markets ranging from meal preparation to dog toys, personal care to private jets. According to Reportlinker (which has its own subscription service), the global subscription e-commerce market was valued at $96.61 billion in 2022 and is expected to grow to $2419.69 billion by 2028.

imaginable, to the extent that the Federal Trade Commission has proposed regulating them. Just as Software as a Service has all but replaced purchased software, subscriptions have infiltrated markets ranging from meal preparation to dog toys, personal care to private jets. According to Reportlinker (which has its own subscription service), the global subscription e-commerce market was valued at $96.61 billion in 2022 and is expected to grow to $2419.69 billion by 2028.

Perhaps the most pervasive subscription space today is digital media, an increasingly crowded arena with unique challenges due to the complexities surrounding contributor compensation. Publishing houses are a subset of this massive digital media market, and as new subscription-based models emerge, publishers are defining how to accurately and fairly compensate contributors in this different paradigm of content consumption.

The evolution of subscriptions

The definition of a subscription has evolved over time. Rental of a single product for a period of time can be considered a form of subscription; perhaps the simplest and most common one. Paying for access to a product series, say a daily newspaper, is another form of subscription. In today’s digital realm, the term subscription is most commonly used for the practice of providing temporary access to a collection of products for a fixed price. The subscription price can be defined based on a period of time, per unit used, or a combination of both.

The attraction of subscription models for businesses is clear: recurring revenue. In a perfect world, this delivers long-term benefits, including:

- Improved revenue predictability, which enables better cost management and profit predictability

- Solidifying future revenue streams

- Capturing new markets

- Opportunities for cost-effective cross-selling and upselling opportunities

Ever since the introduction of e-books and audiobooks, publishing industry players have been devising ways to profitably adopt subscription models. Players in the publishing world’s subscription ecosystem include:

There are several components that add value to these digital content platforms, and all of these variables play a role in the consumer’s subscription purchase—and retention–decision.

- Royalty-bearing and non-royalty-bearing content

- Content navigation capabilities

- Ease/options for content consumption (such as audio options)

- Personalization capabilities

- Integration with other digital systems, e.g., Learning Management Systems (LMSs), testing modules, or homework helpers

How does one define the value each component lends to the subscription experience in order to divide profits fairly and manage the evolution of the subscription model for the future? The mathematics can be mind boggling. In this article, we focus on royalty-bearing content and compensation approaches that impact publishers and authors alike.

New math: author compensation in a subscription-based model

The paradigm shift of author compensation within a subscription model is due to two critical factors:

The paradigm shift of author compensation within a subscription model is due to two critical factors:

- First, there is no longer a purchase that results in permanent ownership of a copy of a book. With a subscription, the reader pays for the temporary right to read the book. Thus, the concept of a “sale” is no longer applicable.

- Second, unlike the purchase of a printed book, the payment for the right to use a book, the selection of the book, and the time when the book will actually be used are unlinked from one another. Subscriptions granting access to multiple titles for a fixed fee grant a right to read books, but they do not dictate which books the reader will actually read, if any. The subscription revenue is generated regardless of whether the subscriber exercises his right and how he does so, while the author’s compensation is tied to the reader actually making use of the book.

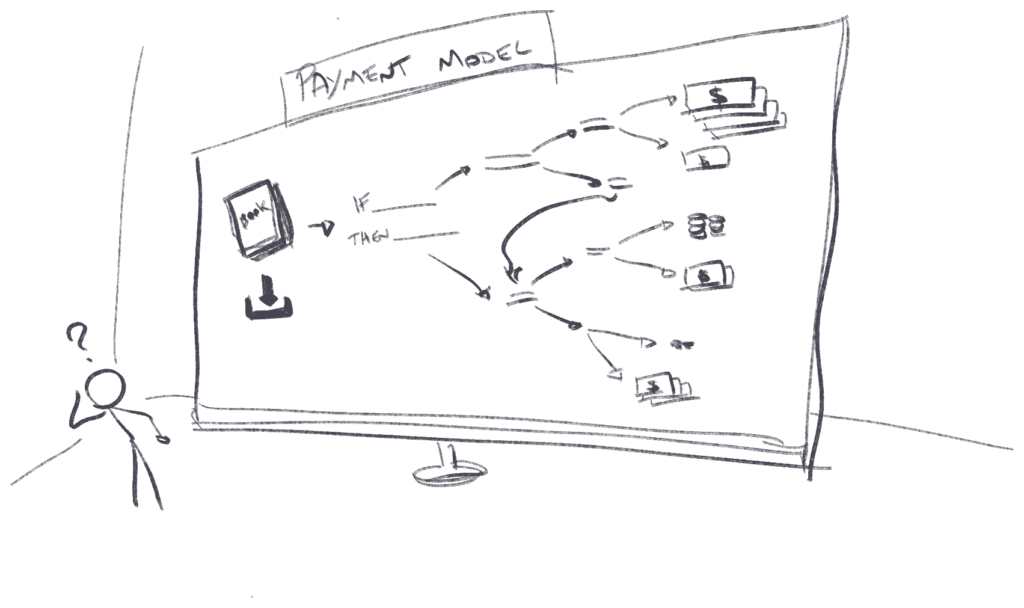

Some sort of compensation model is therefore required to bridge the gap between these fragmented concepts. To arrive at a compensation model, there are four questions a publisher needs to consider:

- How does one define a royalty-bearing event?

- At what point should an author be compensated?

- What sort of calculation algorithm should be used?

- How can publishers make this acceptable to all authors?

Let’s dive in.

1. How does one define a royalty-bearing event?

The publisher or aggregator offering the subscription service must first decide just what a royalty-bearing event is. Is it merely the entitlement, i.e., selecting the title by the paying subscriber and granting access rights to that ISBN? Is it the initiation of reading and, if so, what constitutes initiation? The first word, the first page, the first 15 seconds of the audiobook, or completion of the full work? In fact, in the digital age, should the “use” of the book even be binary? With the purchase of a hardcopy book, things are simple; it is either sold, not sold, or returned. But with electronic subscriptions, should use be defined and priced in increments? Can the author be paid royalties per page read by the reader?

With electronic subscriptions, one can trace pretty much everything. That means subscription models allow immense flexibility of parsing access to the content and pricing it differently across several dimensions: amount of time the access rights are granted, the amount of content, the right to reuse, etc. Since subscription models are both scalable and flexible, the publisher can start with a simple subscription plan and definition of use, then scale to offer more complex and premium subscription plans. For example, the royalty-bearing event in the simple plan can simply be the purchase of the subscription (if the subscriber must choose a title first in order to pay), regardless of how much he reads, while in the second plan the royalty-bearing event can be the actual act of reading or listening to the content.

2. At what point should an author be compensated?

The next question publishers need to answer is when the subscription revenue should be recognized and used for royalty calculation. The payment for subscription, the activation, and the reading may occur at different points in time. If, for example, on January 20, the reader pays for the first month of a $50/month subscription plan that starts on February 1, but he does not read any book until March, in what month should that $50 be recognized and royalties be paid? What if he pays for the annual subscription fully upfront? Should the recognition of that amount be amortized across 12 months?

These are questions that cannot be avoided by publishers, yet a clear answer has yet to emerge. For now, it seems that many publishers recognize the subscription revenue monthly, starting from its activation, and pay royalties irrespective of what and when the subscriber actually reads.

3. What sort of calculation algorithm should be used?

Publishers will likely be forced to decide how to group revenue. In a most basic plan, the subscriber may be limited to accessing a single title per month, which is a 1-to-1 relation between the ISBN and revenue. In a more advanced plan, the access may be unlimited, and publishers normally allocate the revenue to particular ISBNs in the same proportion as that of the ISBN’s usage. However, the publisher may attribute different relative weights to products in the catalog based on their standalone price and the average price of the pool of products. In such cases, the publisher must also decide whether to take the average of all products in the catalog or only the products that were actually used by subscribers in a given period. Regardless of which approach is selected, that average, and thus the weight attributed to a product, will vary from period to period. In the first case, it will vary with the addition of each new product to the catalog. In the second case, it will vary because the usage of titles will never be identical in any two months.

Publishers will likely be forced to decide how to group revenue. In a most basic plan, the subscriber may be limited to accessing a single title per month, which is a 1-to-1 relation between the ISBN and revenue. In a more advanced plan, the access may be unlimited, and publishers normally allocate the revenue to particular ISBNs in the same proportion as that of the ISBN’s usage. However, the publisher may attribute different relative weights to products in the catalog based on their standalone price and the average price of the pool of products. In such cases, the publisher must also decide whether to take the average of all products in the catalog or only the products that were actually used by subscribers in a given period. Regardless of which approach is selected, that average, and thus the weight attributed to a product, will vary from period to period. In the first case, it will vary with the addition of each new product to the catalog. In the second case, it will vary because the usage of titles will never be identical in any two months.

Other factors, depending on the subscription plan, may also be considered. For example, the publisher may further discount the revenue attributed to a single product if they think that some of the value to consumers and their willingness to purchase a subscription was due to platform enhancements that added value to the content or its usability.

4. How can publishers make this acceptable to all authors?

While setting compensation models will not come without growing pains on both sides, these struggles are not without precedent. Remember Napster? The very technology which started a war that nearly torpedoed the music industry later allowed iTunes, Spotify, and YouTube to make it possible for a virtually unknown artist and record label from South Korea to release a single track and turn it into multi-million-dollar global project within months. In 2023, 11 years after the release of Gangnam Style, its video counts 4.7 billion views on YouTube.

The publishing industry may not yet have the same level of maturity when it comes to digital platforms and artist compensation, however as subscription models become more pervasive, the industry will normalize as it strives to achieve a clear and fair definition of the value each contributing part of the subscription brings to the whole. Armed with the right technology, willingness to take risks, and constructive collaboration, publishers will continue to evolve and grow subscription models in a fair and transparent way.

If you would like to explore this subject further, download FADEL’s on-demand webinar, “Understanding and Managing Content Subscription Operating Models” and the coffee talk “Transforming Royalty Operations.”

About FADEL

FADEL, innovator of rights and royalty management software, has worked with some of the biggest names in media, entertainment, publishing, high-tech, and advertising. By automating talent and content rights management across videos, photos, ads, music, products, and brands, and streamlining the processing of licensing royalties, FADEL’s cloud-based solutions have empowered businesses to significantly maximize revenues and increase process efficiencies. Founded in 2003, FADEL is headquartered in New York City and operates offices in Los Angeles, London, Paris, and Lebanon.